Ethereum Price Prediction: Analyzing ETH’s Path to $7,000 Amid Bullish Technicals and Institutional Momentum

#ETH

- Technical Strength: ETH trading above key moving averages with positive MACD momentum indicates bullish technical positioning

- Institutional Support: Significant ETF inflows and growing institutional adoption provide fundamental backing for price appreciation

- Price Targets: Clear resistance at $5,000 with potential for movement toward $7,000 upon successful breakout

ETH Price Prediction

Technical Analysis: ETH Shows Bullish Momentum Above Key Moving Average

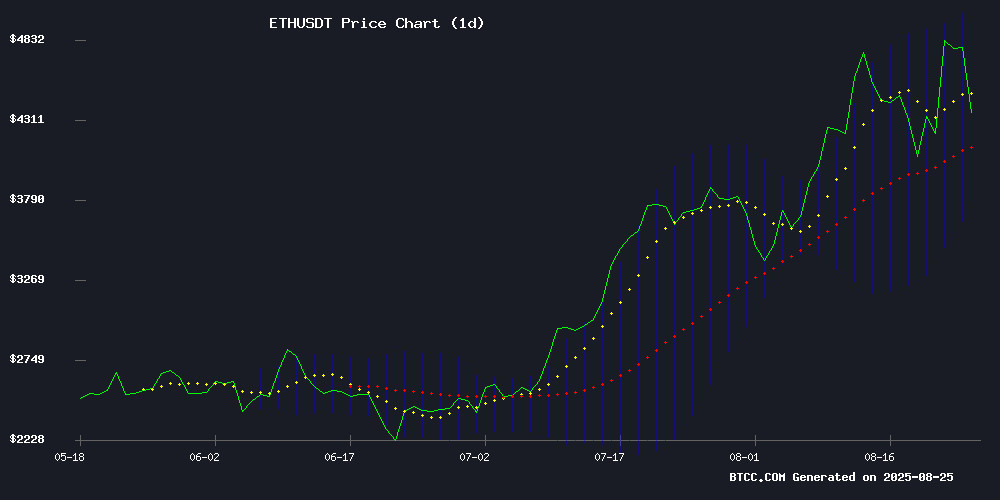

ETH is currently trading at $4,772.83, significantly above its 20-day moving average of $4,383.57, indicating strong bullish momentum. The MACD indicator shows improving conditions with a positive histogram reading of 18.35, suggesting potential upward continuation. Bollinger Bands position the price NEAR the upper band at $5,003.49, indicating potential resistance ahead while maintaining support at $3,763.66.

According to BTCC financial analyst William, 'The technical setup favors continued upward movement with the key resistance level at $5,000. A break above this level could trigger further gains toward new all-time highs.'

Market Sentiment: Institutional Demand and ETF Inflows Drive Optimism

Current market sentiment remains overwhelmingly positive as ethereum approaches the $5,000 milestone. News headlines highlight substantial ETF inflows, institutional adoption, and macroeconomic tailwinds supporting ETH's rally. While some articles note seasonal September headwinds, the overall narrative focuses on potential new all-time highs and price targets reaching $7,000.

BTCC financial analyst William comments, 'The combination of regulatory clarity and growing institutional participation creates a fundamentally strong environment for Ethereum. The $4,600 support level appears solid, providing a foundation for further appreciation.'

Factors Influencing ETH's Price

Ethereum Surges Toward $5,000 Mark Amid ETF Inflows and Macro Tailwinds

Ethereum shattered records with a meteoric rise to $4,945 on Sunday, building momentum after Friday's 15% rally. The breakthrough follows a prolonged battle with its November 2021 peak of $4,878, finally conquered when Federal Reserve Chair Jerome Powell hinted at impending rate cuts.

Spot Ethereum ETFs are fueling the fire, amassing over $1 billion in daily inflows—a historic first since their debut. Institutional players like BitMine Immersion have aggressively accumulated positions, with treasury holdings now exceeding $7 billion. The funds have recently outpaced their Bitcoin counterparts, signaling a potential shift in market leadership.

Ethereum Nears All-Time High Amid Mixed On-Chain Signals

Ethereum hovers just 2% below its record peak of $4,878, defying cautionary alerts from blockchain analysts. Santiment's metrics reveal a precarious 30-day MVRV ratio of 15% and long-term MVRV at 58.5%, historically preceding profit-taking selloffs.

The asset gained 32% monthly and 5% weekly, reaching $4,834 recently. Institutional demand fuels the rally—spot Ethereum ETFs now hold $30.54 billion after consecutive inflow days, with BlackRock's ETHA leading the charge. Stablecoin supply growth (up 10% to $147 billion) underscores robust ecosystem activity.

Ethereum Eyes New All-Time High With $4,600 Support and Growing Market Momentum

Ethereum is poised to challenge its all-time high as bullish momentum builds, with key support holding firm at $4,600. Over 200,000 ETH flowed out of exchanges in two days—a clear signal of long-term conviction among holders.

The cryptocurrency now trades at $4,739, up 0.51% in 24 hours, with $29.91 billion in volume. Analysts see consolidation as a springboard for higher highs, noting that retracements offer strategic entry points.

Market structure suggests accumulation. Exchange withdrawals at this scale typically precede major moves, mirroring patterns seen before previous ETH rallies. The $572 billion market cap underscores Ethereum's dominance in smart contract platforms.

Ethereum's August Rally Faces Historical September Headwinds

Ether surged 25% in August, buoyed by ETF inflows and macroeconomic tailwinds. Institutional interest resurged as ETH tested new highs—yet historical patterns cast a shadow over the rally.

CoinGlass data reveals a nine-year trend: every bullish August since 2016 has been followed by negative September returns, averaging -6.42% for ETH. The pattern intensifies in post-halving years, with analysts warning of amplified downside risk.

Market mechanics now face a critical test. Will 2024 break the September curse, or will seasonal forces prevail? Traders watch key support levels as the calendar turns.

Ethereum Faces Seasonal Headwinds as Institutional Demand Surges

Ethereum's bullish momentum faces a historical test as September approaches. The asset has posted an average loss of 6.42% during this month since 2016, making it ETH's worst-performing period. This seasonal pattern emerges just as Ethereum flirts with all-time highs, trading above $4,700 in mid-August 2025 - a 76% year-to-date gain.

Institutional investors are rewriting Ethereum's demand dynamics. Spot ETH ETFs attracted nearly $3 billion in August inflows while corporate treasuries amassed over $17 billion in ETH reserves. BitMINE Immersion Technologies made waves by accumulating $6.6 billion in ETH, becoming the largest known corporate holder. These capital flows are creating supply constraints that could override seasonal tendencies.

Crypto Weekly Roundup: Regulatory Clarity and Institutional Adoption

Ethereum continues to solidify its position as a leading blockchain for institutional adoption. DBS, Singapore's largest bank, has issued tokenized structured notes on the Ethereum public blockchain, expanding access to sophisticated financial instruments beyond its private clientele. SharpLink Gaming further bolstered Ethereum's institutional appeal with a $667 million acquisition, becoming one of the largest corporate holders of the cryptocurrency.

Regulatory developments took center stage this week. The U.S. Department of Justice provided much-needed clarity, stating that developers won't face charges for unintended protocol misuse—a decision that could foster innovation in the crypto space. Meanwhile, the EU accelerated its digital euro plans, and the Federal Reserve concluded its crypto oversight program.

In technology advancements, Thailand launched an 18-month pilot allowing tourists to convert cryptocurrencies into local currency, signaling growing mainstream acceptance. The PulseChain blockchain gained traction as a scalable Layer 1 solution, offering developers an alternative to Ethereum's congestion and high fees.

Ethereum (ETH) Price Prediction: Potential Rally to $7,000 on Break of Key Resistance

Ethereum is regaining momentum as institutional interest surges, with analysts debating whether ETH could challenge record highs in the coming months. The cryptocurrency currently trades near $4,800, just below its all-time peak of $4,891, fueled by robust inflows into ETH ETFs and escalating Layer 2 activity on networks like Arbitrum and zkSync.

A decisive break above the $4,800-$5,000 resistance zone could pave the way for targets of $6,000 and ultimately $7,000 by late 2025. Market watchers point to Ethereum's recent breach of an 18-month resistance at $4,100 as a bullish signal, with CryptoRank data showing ETH ETF assets swelling to $33 billion from $24 billion in recent weeks.

BitMEX co-founder Arthur Hayes has publicly re-entered Ethereum positions, citing chart patterns suggesting accumulation. The daily chart's broadening wedge formation typically precedes significant upward moves, reinforcing optimism among traders.

Is ETH a good investment?

Based on current technical indicators and market fundamentals, ETH presents a compelling investment opportunity. The cryptocurrency is trading well above its 20-day moving average with strong institutional demand through ETF inflows. Key technical levels suggest potential upside toward $5,000 and beyond.

| Indicator | Current Value | Signal |

|---|---|---|

| Current Price | $4,772.83 | Bullish |

| 20-Day MA | $4,383.57 | Support |

| MACD Histogram | +18.35 | Positive Momentum |

| Bollinger Upper Band | $5,003.49 | Near-term Resistance |

| Support Level | $4,600 | Strong Foundation |

While September typically presents seasonal challenges, the current institutional momentum and technical setup suggest ETH remains well-positioned for continued growth. Investors should monitor the $5,000 resistance level for breakout confirmation.